kaufman county tax appraisal

The grant denial cancellation or other change in the status of an exemption or exemption application. Contact your local County Appraisal District and they will be able to assist you with any exemption qualification questions.

If you are contemplating moving there or just planning to invest in the countys real estate youll come to know whether the countys property tax statutes are.

. Kaufman County is a county located in the US. Kaufman County collects on average 2 of a propertys assessed fair market value as property tax. M F in Kaufman Terrell and Forney.

Please call the assessors office in Kaufman before you send documents or if you need to schedule a meeting. Search For My property value With Us. For over 20 years OConnor has provided property tax consulting services in the Kaufman County Appraisal District and has continuously produced results.

They are maintained by various government offices in Kaufman County Texas State and at the Federal level. A convenience fee of 229 will be added if you pay by credit card. Kaufman County Courthouse 100 W.

The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000. Kaufman County Tax Office Locations. This calculator can only provide you with a rough estimate of your tax liabilities based on the property.

129-901-02 Crandall Independent School District. Its county seat is Kaufman. Kaufman Central Appraisal District.

116-908-02 Quinlan Independent School District. Washington Street Kaufman TX 75142. Monday - Friday.

Information provided for research purposes only. 129-000-00 Kaufman County. The minimum convenience fee for credit cards is 100.

Except for County Approved Holidays Questions. Property Not Previously Exempt2022 Low Income Housing Apartment Capitalization Rate. The fee will appear as a separate charge on your credit card bill to Certified Payments.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. Search tax records in Kaufman and find Appraisal District information. VALUES DISPLAYED ARE 2022 PRELIMINARY VALUES AND ARE SUBJECT TO CHANGE PRIOR TO CERTIFICATION.

Kaufman County has one of the highest median property taxes in the United States and is ranked 251st of the 3143 counties in order. Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents. The eligibility of the property for exemption.

Contact information for the following CAD Districts are as follows. City of Forney 101 Main Street East Forney TX 75126. The Best Way To Hire A Trustworthy Appraiser For Over 25 Years.

The median property tax on a 13000000 house is 136500 in the United States. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Pay Taxes By Credit Card.

Find Kaufman property records property tax rates statistics and much more. Kaufman County Courthouse Annex 100 N. If you have general questions you can call the Kaufman County.

Both the county established. They are a valuable tool for the real estate industry offering both buyers. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

To pay by telephone call 1-866-549-1010 and enter Bureau Code 5499044. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. The median property tax on a 13000000 house is 235300 in Texas.

Learn more View new version. Ad Compare Local Appraisal Experts Using Reviews From Your Neighbors. As of the 2010 census its population was 103350.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Houston St PO Box 819. The County is also responsible for road and bridge maintenance in unincorporated areas maintaining public records collecting property taxes issuing vehicle registrations and transfers.

You can call the Kaufman County Tax Assessors Office for assistance at 972-932-4331. Ad Find My Property Value. Explore how Kaufman County imposes its real property taxes with our in-depth guide.

Vehicle Registration Questions. Kaufman County is responsible for judicial civil and criminal justice adult and juvenile probation human services law enforcement and jail services. Kaufman County Property Tax Appraisal.

Oconnor is the leading company representative for the Kaufman County Appraisal District property owners because. Please contact the Appraisal District to verify all. For more information please visit Kaufman Countys Auditor and Treasurer or look up this propertys current tax situation here.

Vehicle Registration 469-376-4688 or Property Tax 469-376-4689. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. Mulberry Kaufman TX 75142.

The median property tax on a 13000000 house is 260000 in Kaufman County. There is a fee of 150 for all eChecks. Find Kaufman property records property tax rates statistics and much more.

Board Of Directors Wilson Cad Official Site

Kaufman Cad Under Pressure Due To 2019 Values

![]()

Contact Kaufman Cad Official Site

Kaufman Central Appraisal District

Kaufman Central Appraisal District

Kaufman Central Appraisal District

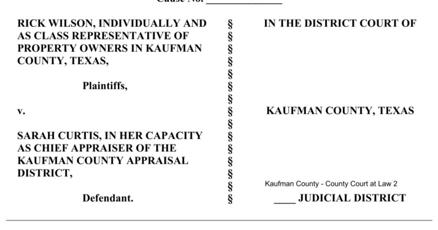

Forney Mayor Files Suit Against County Appraisal District Business Inforney Com

Property Values Rising Again In Kaufman County Around Town Kaufmanherald Com

Censored Property Taxes Texas Hunting Forum

Forms Kaufman Cad Official Site

Part 1 Winning Against A Corrupt Texas Property Tax System By David Watts Jr Medium